Facts About Transaction Advisory Services Revealed

A Biased View of Transaction Advisory Services

Table of Contents5 Simple Techniques For Transaction Advisory ServicesNot known Factual Statements About Transaction Advisory Services A Biased View of Transaction Advisory ServicesAll About Transaction Advisory ServicesLittle Known Questions About Transaction Advisory Services.

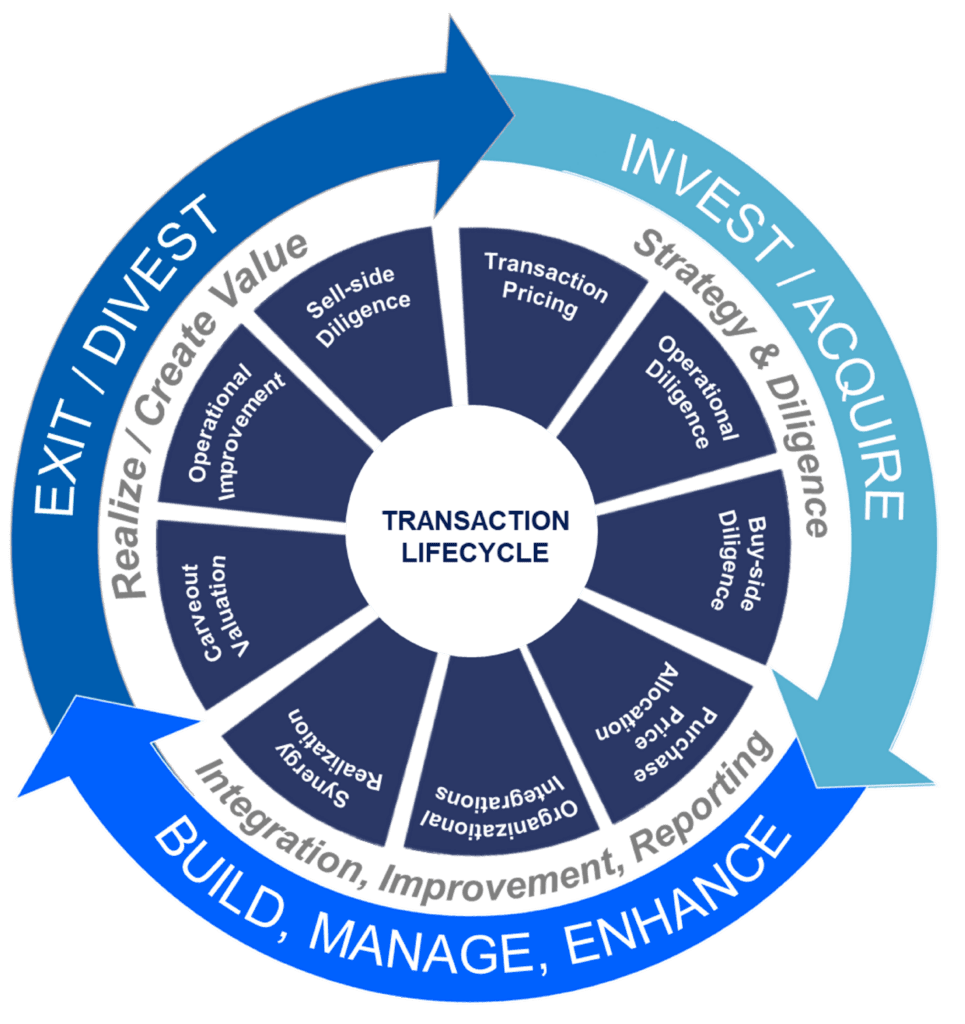

This action makes sure business looks its finest to prospective purchasers. Obtaining the business's worth right is vital for a successful sale. Advisors use different methods, like reduced cash money circulation (DCF) evaluation, comparing with comparable companies, and current purchases, to figure out the fair market worth. This aids set a reasonable rate and negotiate properly with future buyers.Transaction advisors action in to assist by getting all the required information organized, addressing concerns from customers, and arranging brows through to the service's location. Transaction consultants use their knowledge to help company proprietors take care of tough arrangements, meet buyer assumptions, and structure deals that match the proprietor's objectives.

Meeting legal rules is important in any kind of business sale. They help business owners in preparing for their following steps, whether it's retired life, starting a brand-new endeavor, or managing their newfound riches.

Transaction consultants bring a wide range of experience and knowledge, making sure that every aspect of the sale is handled professionally. Through calculated prep work, appraisal, and arrangement, TAS aids entrepreneur accomplish the greatest possible list price. By making sure lawful and governing compliance and managing due diligence alongside various other bargain staff member, transaction experts reduce prospective dangers and obligations.

An Unbiased View of Transaction Advisory Services

By contrast, Huge 4 TS teams: Deal with (e.g., when a potential buyer is performing due persistance, or when a bargain is closing and the buyer needs to incorporate the firm and re-value the vendor's Annual report). Are with fees that are not connected to the offer closing successfully. Gain charges per interaction somewhere in the, which is less than what financial investment banks make also on "little deals" (but the collection probability is also a lot greater).

, but they'll concentrate much more on audit and valuation and much less on subjects like LBO modeling., and "accounting professional only" subjects like test balances and exactly how to walk via events making use of debits and credit ratings rather than monetary statement modifications.

Little Known Questions About Transaction Advisory Services.

that demonstrate exactly how both metrics have altered based upon items, networks, and consumers. to judge the precision of monitoring's previous forecasts., including aging, inventory by product, ordinary levels, and provisions. to establish whether they're completely fictional or somewhat credible. Professionals in the TS/ FDD teams may likewise talk to management about everything above, and they'll write an in-depth record with their searchings for at the end of the procedure.

The hierarchy in Transaction Services differs a little bit from the ones in financial investment banking and personal equity professions, and the general shape resembles this: The entry-level duty, where you do a great deal of data and monetary analysis (2 years for a promotion from here). The next degree up; comparable work, however you get the more intriguing little bits (3 years for a promotion).

Particularly, it's tough to get advertised beyond the Supervisor degree due to the fact that couple of people leave the work at that stage, and you need to start revealing evidence of your capacity to produce revenue to advancement. Allow's start with the hours and way of life given that those are easier to explain:. There are periodic late evenings and weekend break work, yet absolutely nothing like the frantic nature of click to investigate financial investment banking.

There are cost-of-living changes, so expect reduced compensation if you're in a less expensive area outside major financial centers. For all settings except Companion, the base pay comprises the bulk of the complete compensation; the year-end bonus may be a max of 30% of your base pay. Typically, the ideal method to increase your profits is to change to a various company and negotiate for a higher salary and bonus offer

Top Guidelines Of Transaction Advisory Services

You could get into business advancement, but investment financial obtains harder at this stage because you'll be over-qualified for Expert duties. Company financing is still a choice. At this stage, you need to simply stay and make a run for a Partner-level function. If you wish to leave, maybe transfer to a customer and page execute their valuations and due persistance in-house.

The primary issue is that since: You typically need to sign up with an additional Huge 4 group, such as audit, and job there for a couple of years and then relocate into TS, job there for a few years and after that relocate into IB. And there's still no warranty of winning this IB function because it depends on your area, clients, and the working with market at the time.

Longer-term, there is likewise some threat of and due to the fact that reviewing a firm's historical economic info is not exactly brain surgery. Yes, people will certainly always need to be involved, but with even more advanced modern technology, reduced headcounts can potentially sustain customer involvements. That stated, the Transaction Solutions team beats audit in regards to pay, work, and leave opportunities.

If you liked this post, you might be curious about reading.

Examine This Report on Transaction Advisory Services

Establish innovative financial frameworks that aid in establishing the real market price of a company. Offer consultatory operate in relationship to organization valuation to help in negotiating and prices structures. Clarify one of the most appropriate kind of the offer and the kind of factor to consider to utilize (cash, supply, gain out, and others).

Perform assimilation planning to figure out the process, system, and business changes that might be called for after the deal. Establish standards for integrating divisions, innovations, and business procedures.

Evaluate the prospective client base, sector verticals, and sales cycle. The functional due diligence supplies essential understandings into the functioning of the firm to be obtained worrying threat analysis and worth production.